As earnings season begins, many investors are focused on reports from mega-cap companies. However, we believe a more prudent approach is to shift attention toward cyclical stocks, which offer key insights into the broader economy. These companies, being closely tied to economic cycles, can provide early signals of shifts in market conditions. By analyzing their performance, investors can gain a clearer understanding of the health of the overall market, rather than solely focusing on tech giants.

Recent economic indicators have been mixed, with unemployment data being interpreted in various ways, depending on the narrative. The Federal Reserve appears to believe the economy is at an inflection point, prioritizing employment over fighting inflation. Cyclical stocks, which are more sensitive to economic shifts, may be the first to show signs of stress if trouble is ahead. While some metrics suggest resilience, others point to underlying weaknesses, placing cyclicals at the heart of economic uncertainty and making them critical to watch.

These companies tend to carry more leverage and are more vulnerable to interest rate changes. Despite a gradual decline in rates, cyclicals are still feeling the effects of a higher rate environment. As a result, their earnings and profit margins could be more significantly impacted by changes in economic growth.

In contrast, mega-cap companies, which dominate the headlines, are less sensitive to shifts in economic conditions. These widely followed firms are often discussed in terms of growth potential. Thanks to their dominant market positions and diversified revenue streams, they are better equipped to absorb economic shocks. While they offer relative stability, they may not provide as much insight into the economy’s health as cyclical stocks do.

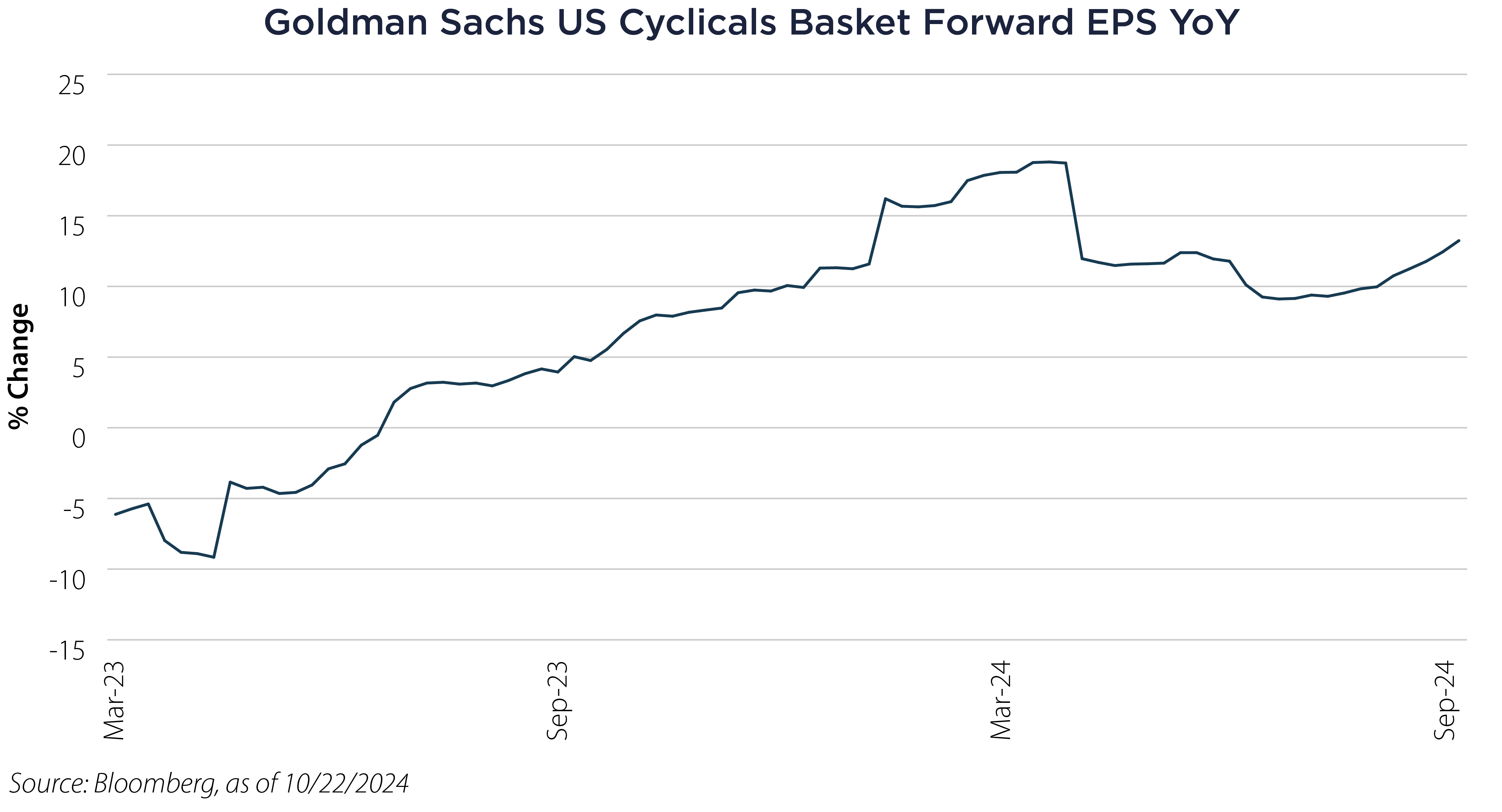

The accompanying chart highlights the estimated earnings growth of cyclical stocks, which remains strong and may even be reaccelerating. This earnings season will be pivotal in determining whether these projections hold, offering a clearer picture of the market's strength moving forward. Strong earnings from cyclicals could indicate that the broader economy is outperforming expectations, while disappointing results might signal emerging weaknesses not yet reflected in broader economic data.

Important Disclosures & Definitions

Beta: a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market or a benchmark. The beta of the market or benchmark is 1.00 by definition. An investment with a beta above 1 is more volatile than the overall market, while an investment with a beta below 1 is less volatile.

Goldman Sachs (GS) US Cyclicals Basket: consists of S&P 500 Index names with beta-to-US GDP growth (via the GS US MAP score of economic data surprises) higher than the S&P 500 Index's beta excluding energy, materials and other macro affected pockets of the market. The basket is highly diversified with a max weight of 2% at creation and is liquidity optimized to trade over $1bn in a day with no name exceeding 2.5% average daily volume.

S&P 500 Index: widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

One may not invest directly in an index.

AAI000781 10/29/2025