The recent surge in the stock market offers multiple perspectives for analysis. Since Q3 2022, the S&P 500 Index has delivered an extraordinary annualized gain of over 26%. This rally has been largely fueled by the narrative of artificial intelligence (AI) revolutionizing industries, propelling growth stocks to exceptional performance.

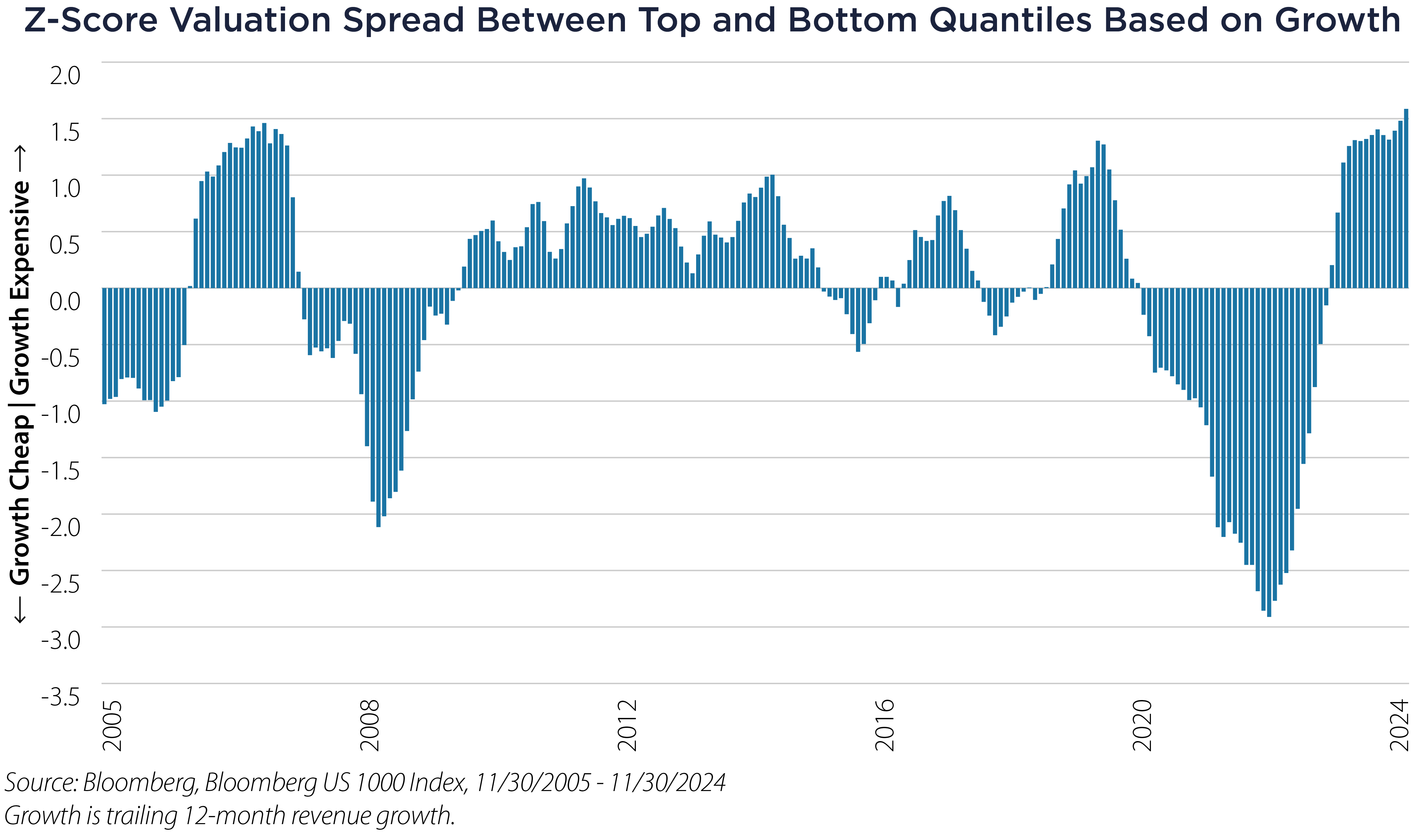

Alternatively, this market strength can be viewed simply as a reversion to the mean. In the first three quarters of 2022, the Russell 1000 Growth Index declined by approximately 30%, leaving growth stocks historically undervalued compared to the broader market. Despite the recent rally, growth stocks have only recently become noticeably overvalued, signaling a swing of the valuation pendulum – and another context in which to view the recent outperformance.

Today, the S&P 500 trades at 22 times forward earnings, a level approaching the highs seen post-COVID-19 in 2021. This valuation is well above the 10-year median price-to-earnings ratio of 17.7, warranting caution regarding future stock performance. Growth stocks, in particular, appear stretched in valuation relative to the market.

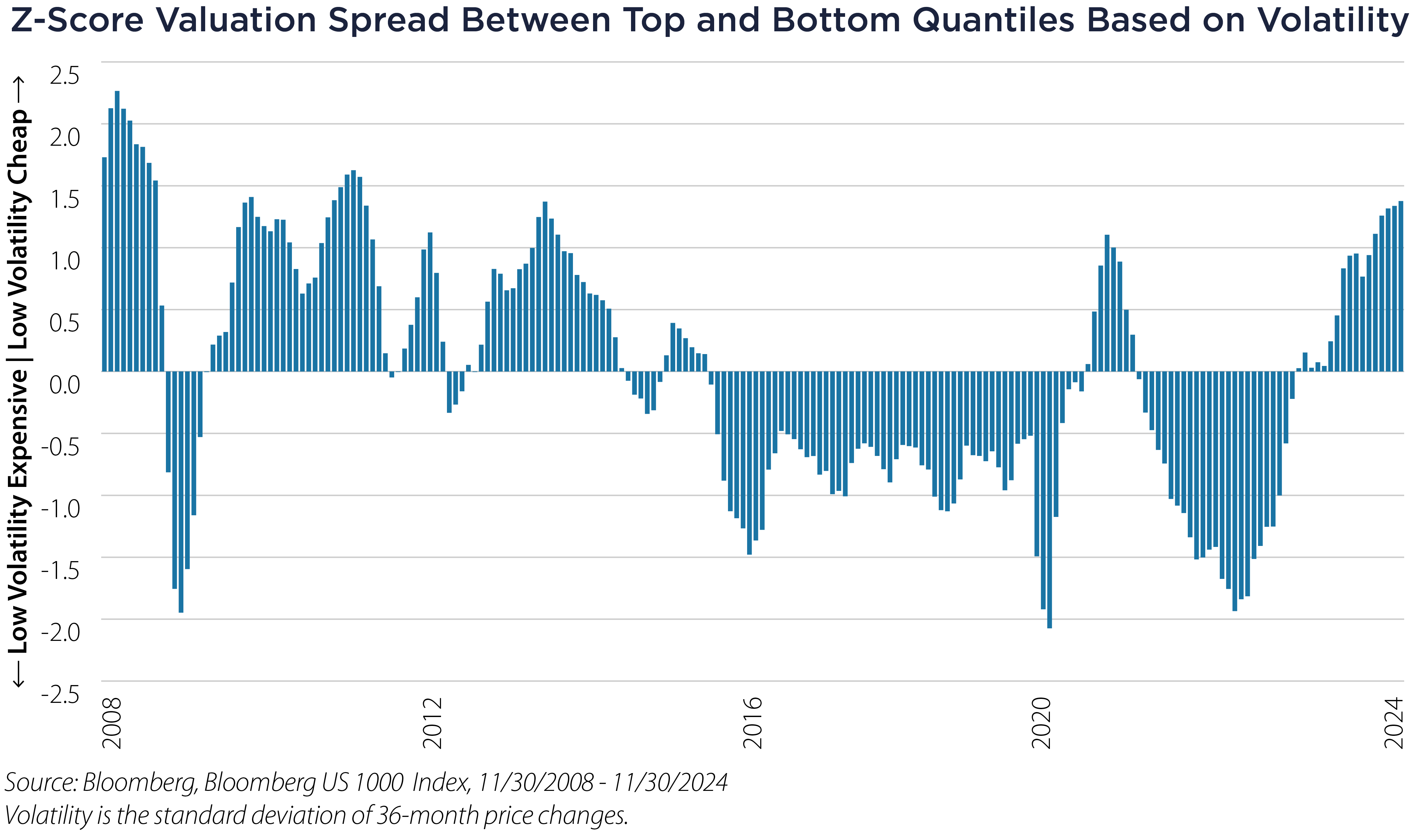

Conversely, low-volatility stocks have underperformed since Q3 2022, following a period when they were historically overvalued. This pendulum has swung in the opposite direction, making low-volatility stocks relatively attractive compared to their growth counterparts. As general stock prices remain elevated, these lower-risk equities could present an opportunity for investors seeking value.

In summary, while growth stocks have thrived, caution is warranted given overvaluation concerns, and low-volatility stocks may offer a compelling alternative in the current environment.

Important Disclosures & Definitions

Bloomberg US 1000 Index: a float market-cap-weighted benchmark of the 1000 most highly capitalized US companies.

Price/Earnings (P/E) Ratio: a valuation ratio of a company's current share price compared to its per-share earnings.

Russell 1000 Growth Index: measures the performance of the large-cap growth segment of the US equity universe. It includes those Russell 1000 companies with relatively higher price-to-book ratios, higher Institutional Brokers' Estimate System forecast medium term (2 year) growth and higher sales per share historical growth (5 years).

S&P 500 Index: widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Z-Score: a numerical measurement that describes a value's relationship to the mean of a group of values, measured as standard deviations from the mean. If a Z-score is 0, it indicates that the data point's score is identical to the mean score. A Z-score of 1.0 would indicate a value that is one standard deviation from the mean.

One may not invest directly in an index.

AAI000873 01/14/2026