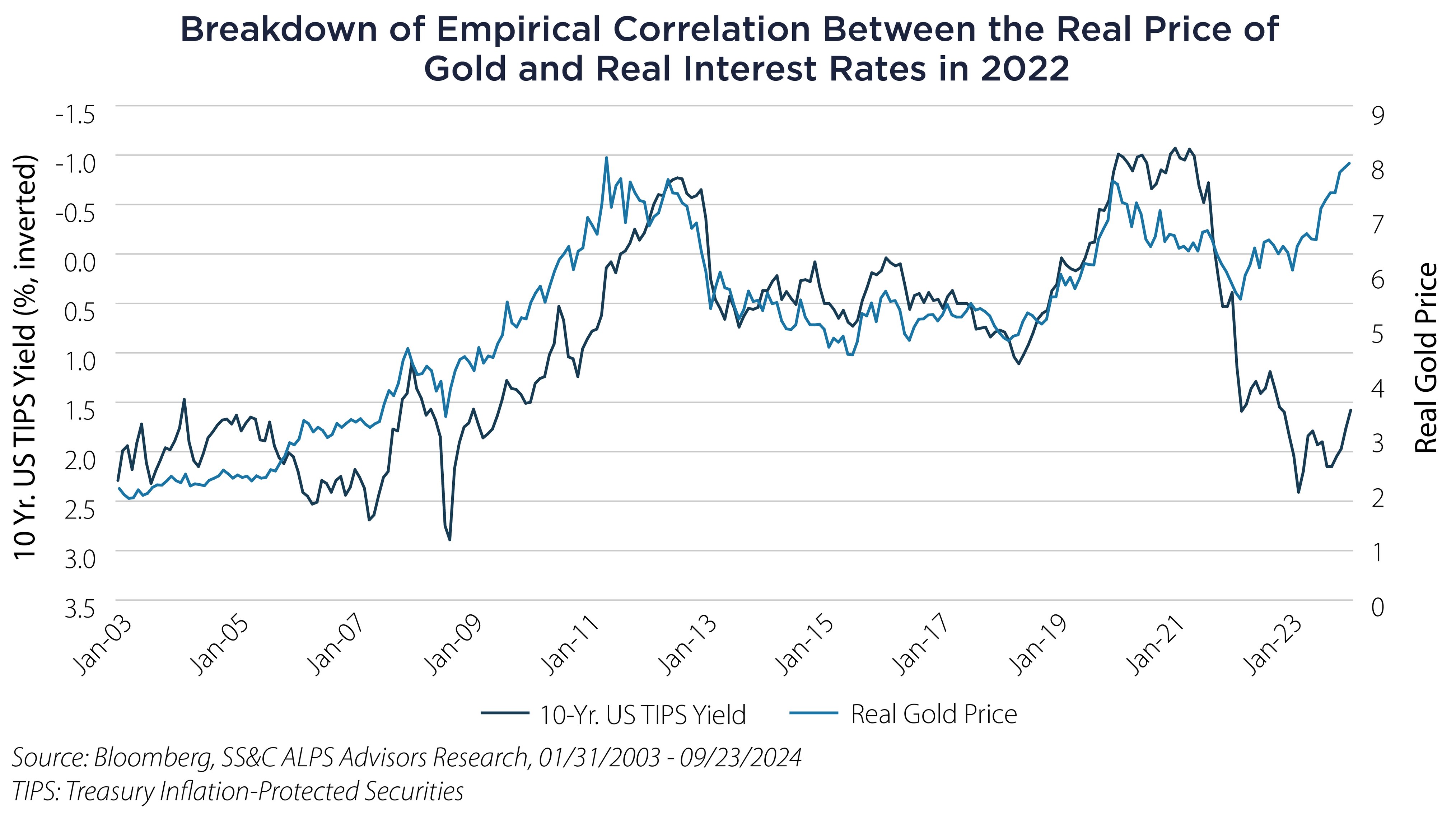

• Real gold prices over the last 20 years have shown a remarkably strong correlation with real interest rates.1

• In 2022, there was a breakdown in this relationship: real rates climbed rapidly as the rate of inflation fell, but gold prices climbed.

• We are at the inflection point where real rates are beginning to come back down, but gold prices never experienced a correction after their trend-bucking increase.

• Will the old trend be re-established at this new, higher level? Or will gold prices go through a period of lackluster returns as real rates fall, bringing the old relationship back into balance?

Over the last 20 years, real gold prices have exhibited a strong correlation with real interest rates. The economic rationale for this relationship stems from the opportunity cost of holding gold. When real rates are high, an investor can get positive real returns from interest-bearing instruments (fixed income). When real rates are negative, interest-bearing instruments actually lose money for investors, while gold might behave as a store of value.

This relationship broke down in 2022 when US real rates surged as the Federal Reserve pushed up short-term rates and inflation began to fall. Contrary to expectations, gold prices rose during this period, breaking away from their historical trend.

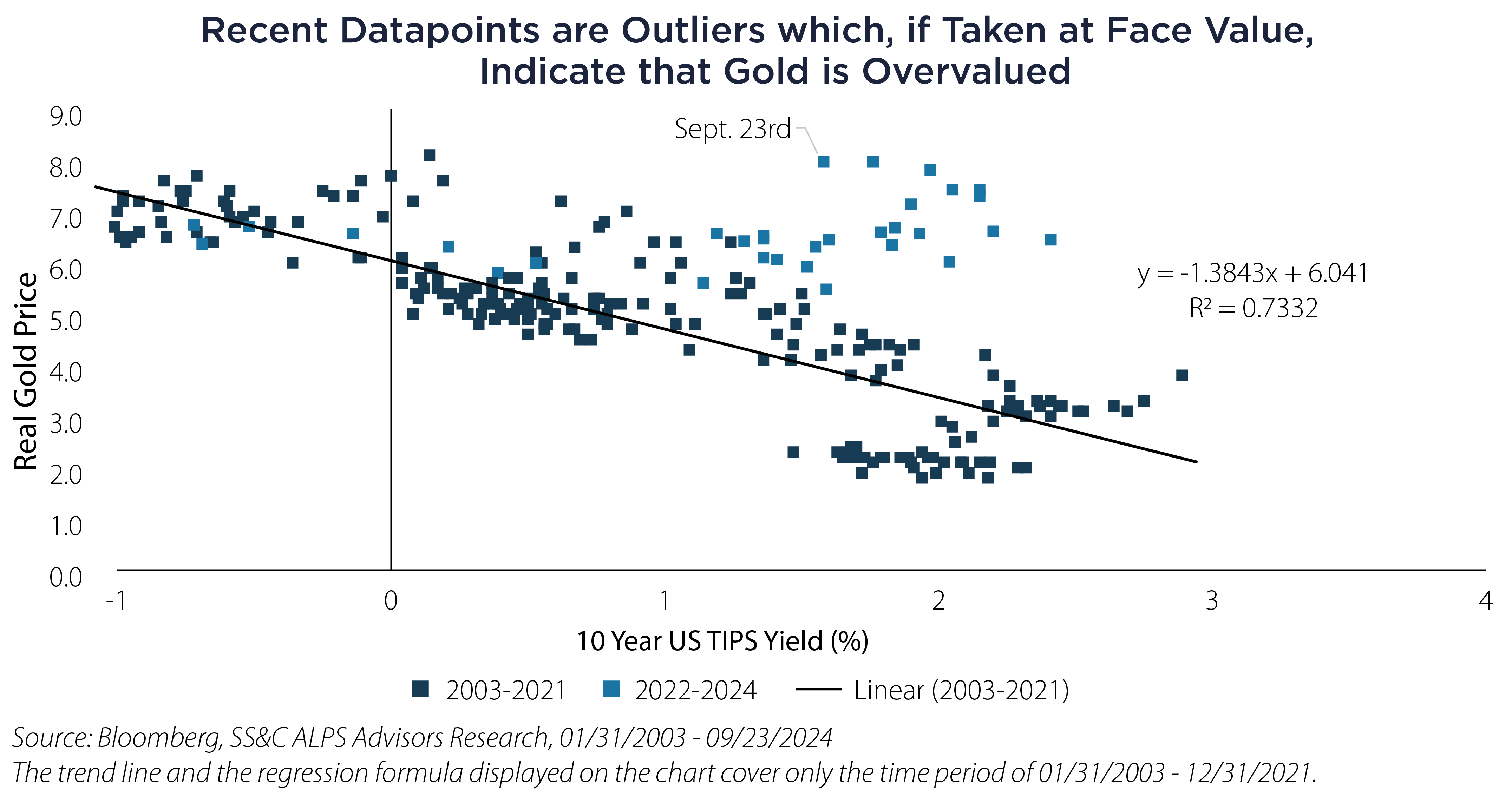

Plotting the two time series against each other (instead of against time, as in the first chart), we are able to visualize the strength of the relationship and easily identify the outliers. The very strong relationship between the two variables from 2003 through 2021 is visible in the R2 statistic of 0.73, which drops to 0.47 if the time period is expanded through 2024.

We are now at a critical juncture, where real interest rates have begun to descend again. However, gold has yet to experience a correction after its trend-bucking price increase. This begs the question of whether falling real rates will actually provide the same price support they historically have, pushing gold up from its already elevated position and re-establishing the relationship at a higher base.

Alternatively, has gold simply been ahead of the decline in real rates, reaching its equilibrium price ahead of the interest rate move? The latter scenario implies gold may not receive price support as rates fall but may simply be predicting near-zero or even negative real rates on the horizon.

Important Disclosures & Definitions

1 Source: SS&C ALPS Advisors Research. The real gold price is the price of one ounce of gold (XAU Currency) in USD divided by the US Consumer Price Index (CPI INDX). Data sourced from Bloomberg. Time period analyzed is 01/31/2003 – 09/23/2024.

Consumer Price Index (CPI): a measure of the average change over time in the prices paid by urban consumers for a representative basket of consumer goods and services. One may not invest directly in an index.

R-Squared (R2): in investing, R-squared is generally interpreted as the percentage of a fund or security's movements that can be explained by movements in a benchmark index. An R-squared of 100% means that all movements of a security are completely explained by movements in the index.

AAI000767 10/01/2025