The 2024 US Open was wicked. Unpredictable rough, challenging pin placements and greens that read above 12 on the stimpmeter made for scrappy golf and a nerve-racking finish. For such a beautiful game where players are artists, heavily relying on feel and creativity, it was ultimately won by somebody dubbed “The Scientist”.

Bryson DeChambeau is known for being unconventional, and his post-round interview was no exception:

“I put my golf balls in Epsom salt… we float golf balls in a solution to make sure that the golf ball is not out of balance. There was a big thing back in the day that golf balls are out of balance, and it’s just because of the manufacturing process. There’s always going to be an error, especially when it’s a sphere and there’s dimples on the edges. You can’t perfectly get it in the center.

So what I’m doing is finding pretty much the out-of-balanceness of it, how much out of balance it is. Heavy slide floats to the bottom, and then we mark the top with a dot to make sure it’s always rolling over itself … For most golf balls that we get, it’s not really that big of a deal. I just try to be as precise as possible…”

- Bryson DeChambeau, June 16, 2024

Beyond the humor, it perfectly points to addressing estimation error when trying to balance a portfolio.

The most common way to estimate return and risk of asset classes and asset class segments is to compute the mean, variance and covariance of their historical returns. This seems practical as we can summarize how assets have behaved given their available pricing history. However, creating such a summary of behavior would implicitly inform a portfolio optimization that the forthcoming return, risk and correlation of assets will look like an (out of balance) statistically manufactured composite of their available history.

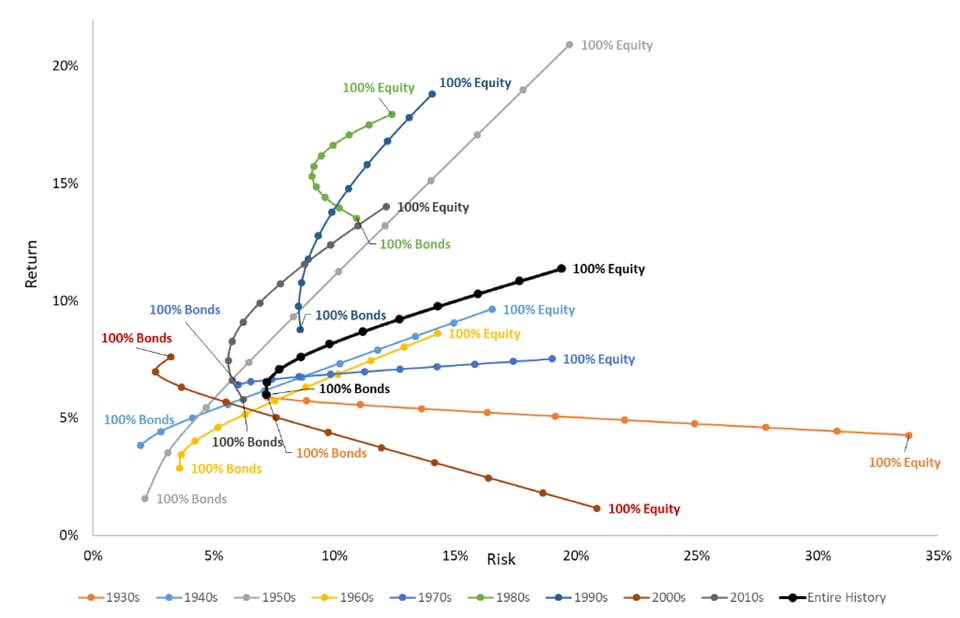

To illustrate, in the associated figure we’ve plotted the realized efficient frontiers of stock and bond blended portfolios for each decade back to 1930. We have also plotted the efficient frontier built from the entire history in black. Importantly, the historical composite lies far away from over half of the realized decades. Furthermore, using an efficient frontier from the previous decade to predict the following decade in most cases would lead the portfolio astray. This is a clear visualization of the estimation error associated with leaning too heavily on contemporary data or long-term statistical composites to generate estimates of future return.

There are several ways we deal with estimation error in portfolio optimization, including resampling (our version of Epsom salt) and Bayesian methods (e.g., Black Litterman). This process and more are outlined in our Model Portfolio Framework.

Important Disclosures & Definitions

Stimpmeter: a device used to measure the speed of a golf course putting green by applying a known velocity to a golf ball and measuring the distance traveled in feet. A green speed of 7 is generally considered very slow and is slower than a green speed of 9 (a moderate speed). A stimp rating of 13 or 14 is considered lightning-fast.

AAI000718 07/02/2025