"Someone's sitting in the shade today because someone planted a tree a long time ago."

- Warren Buffet

Summer Internship

By way of background and introduction, I’m a finance major at Colorado State University and wrapping up my summer internship at SS&C ALPS Advisors.

My personal investment journey began during the COVID-19 pandemic in 2020. This period, marked by the rise of meme stocks, significantly influenced my initial foray into the market. My family, especially my dad and brother, have always been heavily into investing. Their long-term, patient approach contrasted with my initial excitement about quick gains. However, over time, I have evolved from trading meme stocks to becoming a more disciplined option and swing trader, with a separate focus on building a solid IRA account for retirement.

During my internship, I’ve gained invaluable insights that have shaped my investment strategy. I'm learning to look at the bigger picture with a longer term perspective to better understand various market influences and to better keep my emotions in check. Through several research projects, I was exposed to the asset management/advisor ecosystem and the rapidly changing dynamics of investment advice, such as model portfolios, application of artificial intelligence (AI) and the rapidly changing demographics of investors.

This experience has taught me the importance of not overreacting based on market fluctuations, a lesson that has been crucial in refining my approach to investing. Furthermore, I've come to appreciate the value of thorough research and patience in making well-informed investment decisions as well as the role of the financial advisor and the value they create for their clients.

Considerations for Advisors

Through my research this summer, I came across a number of interesting data points about investing and financial advisors. Most notably:

- The average age of a financial advisor in the US is 55 years old.

- The average holding period for stocks has drastically reduced from eight years in the late 1950s to just five and a half months by June of 2020.

- 56% of Gen Z (ages 18-24) began investing in 2020.

For some anecdotal perspective, I also polled classmates and friends regarding investing:

- Two out of ten classmates invest in the market daily.

- My interest in the capital market is 9/10 compared to a peer average of 4/10.

- Ten percent of my friends own a brokerage account.

For us young investors, our preferences and behaviors are distinct compared to previous generations. We are drawn to high-risk, high-return opportunities, driven by a blend of impatience for long-term gains and a strong value-driven mindset. The tech sector holds appeal for us because we see technology as the future and engage with it daily. Moreover, we are highly sensitive to investment fees, leading us to favor low-cost options and frequently switch from traditional investment routes.

The “Meme Stock”

To attract Gen Z customers like me, advertising on platforms like Instagram can be highly effective. We often vet companies via social media before engagement. Investment opportunities should pass the social media check, as Gen Z is influenced by “Finfluencers'' who promise high returns. The rise of "meme stocks," which gain popularity through social media hype rather than traditional financial metrics, has further shaped our investment strategies and preferences. It's important to note that over 64% of Gen Z has fallen victim to "get rich quick" schemes, making us cautious of lucrative promises.

Values vs Money?

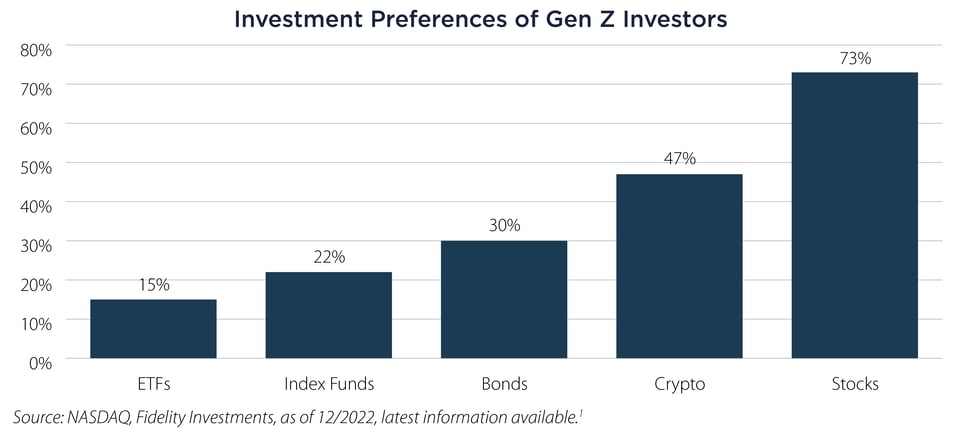

It’s important to understand environment, social and governance (ESG) stocks, especially for my generation. While 25% of Gen Z and Millennials own ESG stocks, 32% do not know what an ESG stock is. Research by Morgan Stanley shows that 90% of Gen Zers believe companies should address environmental and social issues, highlighting the strong ESG values held by Gen Z. As illustrated nearby, 73% of Gen Z owns stocks, 15% use ETFs, 30% hold bonds and 22% buy index funds. Additionally, 47% own crypto stocks, reflecting our affinity for technology-driven investments.

With that being said, word of mouth plays a significant role for investors like me, as we often rely on recommendations and discussions within our peer groups to guide our investment decisions.

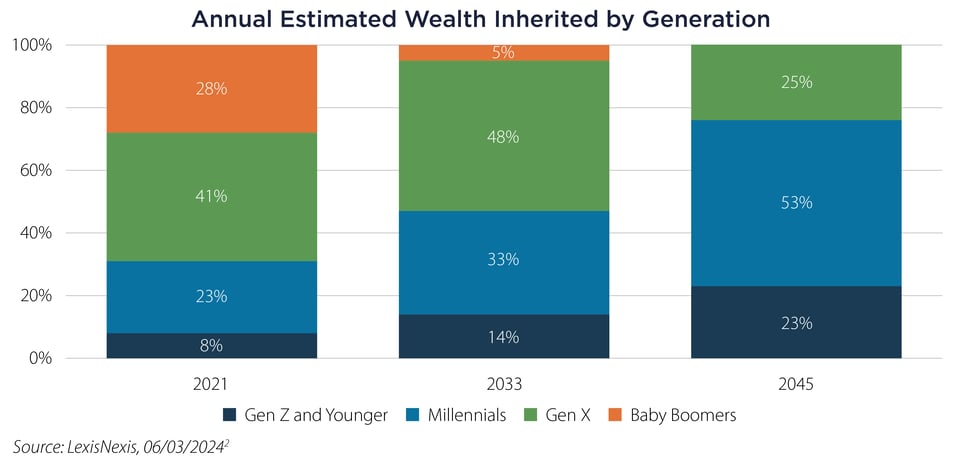

Gen Z Share of Wealth

The future looks incredibly promising for Gen Z, making it crucial for advisors to understand our unique perspectives. As illustrated nearby, our share of inherited wealth over the next two decades is projected to soar from 8% in 2021 to an impressive 23% by 2045. This dramatic shift positions Gen Z investors to play a significant role in the economic landscape. During the same period, Gen X will experience a reduction of almost 50%, from roughly 41% to 25% while Millennial wealth will more than double from 23% to 53%. These shifts indicate a major generational wealth transfer that will reshape economic dynamics and the investment landscape for investors and advisors.

Impact on the Market

The shift towards dynamic, tech-focused investment strategies among us Gen Z investors, driven by high-risk, high-return preferences and a focus on low fees and financial literacy, requires traditional advisors to adapt.

With a substantial portion of young investors owning ESG stocks and heavily relying on social media, financial professionals will need to enhance their online presence and value proposition to align with these values. The upcoming generational wealth transfer will amplify these trends, making understanding and engaging with us crucial for future market success.

When I retire and look back, I hope I will remember the importance of understanding the economy and making decisions based on logic rather than emotions. I want to see that I built a solid foundation of discipline through times of volatility and uncertainty while maintaining a level head through both bullish and bearish markets.

I plan to save aggressively, build an investment portfolio and at some point work with an advisor attuned to the unique requirements of Gen Z investors to craft a plan to help accomplish my long-term financial goals.

Cameron Schoffman

Colorado State University

Class of 2025

Business Administration with dual concentrations in Finance and Supply Chain Management

Important Disclosures & Definitions

1 Fidelity Investments. (12/2022). It’s time to change your mind about young investors: How the next generations can help your firm grow, and what you can do to win their business.

2 LexisNexis. (06/03/2024). Financial Services Trends for Gen Z and What that Means for Financial Pros.

AAI000736 08/13/2025