Even with the extra day in February this Leap Year, March always seems to come sooner after the New Year than expected. March means Spring is just around the corner and is a reminder tax deadlines are rapidly approaching. This got our team thinking about the direction of taxes, tax strategies and mental frameworks investors use to manage taxes.

But first, let’s start with our team’s view on taxes. At a very basic level, we believe taxes - at the Federal, State and Local level - are going higher. Why?

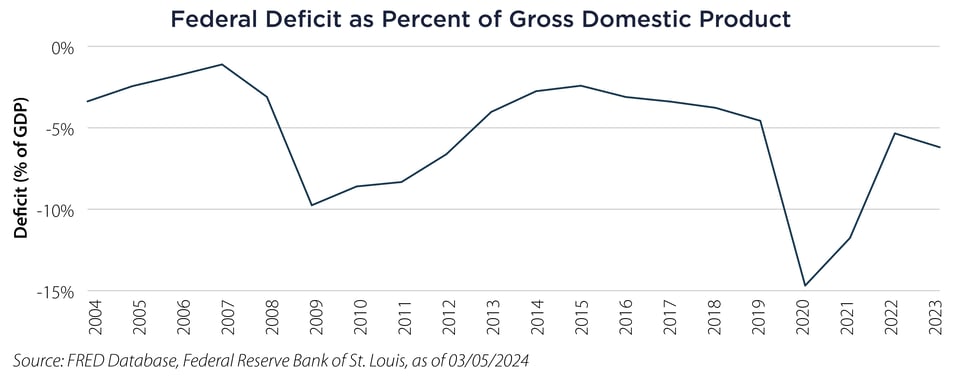

- Federal deficit levels as a percentage of GDP were historically high during the COVID-19 Pandemic, and although deficits have narrowed they remain very high today.

- Debt as a percentage of GDP at 121%1 is historically high, only eclipsed during the Pandemic when GDP collapsed.

- According to a recent presentation by the team at DoubleLine, assuming the current tax system and current interest rates, 50% of all tax receipts will go to cover the interest expense on US Government debt in five years.2 Our government has too many obligations for that to be true, and it is almost certain interest rates won’t be at current levels in five years – however, the point remains valid.

Our intention is not to scare investors, rather it is to encourage investors to be smart and prepare. The US will manage through this period of high debt levels with some combination of raising taxes, higher inflation and stronger GDP. But now is the time for investors to think ahead and prepare positioning for higher taxes.

There are four primary ways we think about preparing a household for higher taxes: Asset Selection, Asset Location, Tax Optimization and Householding. Used together in a cohesive strategy investors have all the tools required to be in the best position possible to compound returns without unnecessary tax drag.

Asset Selection

Asset selection is a foundational step in a tax-sensitive investment strategy. It goes beyond merely picking securities that promise high returns; it requires an investor to consider the tax implications of where those returns are generated. For instance, income-generating investments such as bonds or dividend-paying stocks might be better placed in tax-deferred accounts like IRAs or 401(k)s. These accounts allow for the postponement of tax payments until funds are withdrawn, which can be strategically planned for a time when the investor is in a lower tax bracket. Conversely, investments that are expected to appreciate in value, like growth stocks, are more tax-efficient in taxable accounts. When these assets are sold, they are subject to capital gains tax, which is generally lower than the tax on income. Additionally, if held for more than a year, they qualify for long-term capital gains tax rates, which are significantly lower than short-term rates. Furthermore, municipal bonds present an attractive option as the interest income they generate is often exempt from federal income tax and, in some cases, state and local taxes as well. This can make them highly beneficial for investors in higher tax brackets. Finally, consider fund structure when targeting an investment strategy; in the hands of an experienced portfolio manager, ETFs tend to be more tax efficient than Mutual Funds all else equal.

Asset Location

The principle of asset location is an extension of asset selection. It’s not just about what assets you own; it's about where you hold them. Tax efficiency can be maximized by ensuring that investments are placed in the most appropriate type of account. For example, Tax Exempt accounts are best for holding assets with the highest expected returns or the least tax efficient structures. This could also mean placing high-yield investments in tax-advantaged accounts where the tax on income can be deferred. In contrast, investments with lower income distributions but high growth potential might be better suited for taxable accounts. Here, they can benefit from capital gains treatment and the ability to be gifted or bequeathed with a step-up in basis. The location of an asset can be as crucial as the selection of the asset itself, with the potential to significantly impact the after-tax return of an investment portfolio.

Tax Optimization

Strategic thinking in taxable accounts is equally vital. Every sale within these accounts can potentially create a taxable event. Thus, the trading and rebalancing that might be commonplace in a tax-advantaged account can have unintended consequences in a taxable account. This does not mean that taxable accounts should be static, but rather that an investor needs to be more deliberate with transactions. For example, employing a buy-and-hold strategy can minimize capital gains taxes. Additionally, when rebalancing is necessary, it can often be done in a way that utilizes tax loss harvesting, where the sale of investments at a loss can offset gains, thereby reducing the taxable income. The goal is to maximize after-tax returns, not just the gross returns of the investments.

Householding

Lastly, coordinating exposures, holdings and actions across all accounts requires a holistic view of one's finances. An investor’s accounts should not operate in silos but rather as parts of a cohesive whole. This means looking at the overall allocation across all accounts and making sure that the allocation fits the individual's risk tolerance, investment goals and tax situation. It involves ensuring that the investment decisions made in one account complement those in another, rather than contradict them or create an unnecessary tax burden. For instance, if tax rates are expected to rise, it might be prudent to increase contributions to Roth accounts, where withdrawals are tax-free, rather than traditional tax-deferred accounts. It also means coordinating the timing of income recognition and deductions across accounts to manage taxable income in the most efficient manner possible.

Conclusion

We believe it is very likely tax rates will rise in the future and investors should prepare now before being forced to make sub-optimal decisions with negative tax consequences in the future. By carefully selecting assets, optimizing asset location, strategically managing taxable accounts and coordinating investment decisions holistically across all accounts, investors can create a tax-efficient portfolio that not only strives to minimize tax liabilities but also works to achieve their broader financial goals. This is an ongoing process rather than a set-it-and-forget-it strategy and requires regular review as tax laws and personal circumstances evolve. While tax season is currently underway, preparing for tax season should be on-going and forward looking.

Important Disclosures & Definitions

1 Bloomberg, as of 03/05/2024.

2 DoubleLine Round Table Prime, 2023 - Part 1: Macroeconomic "State of Play", 01/04/2023.

AAI000638 03/12/2025