• Despite positive market signals following the March 2023 banking crisis, persistent issues prompt a comprehensive overview of the banking industry.

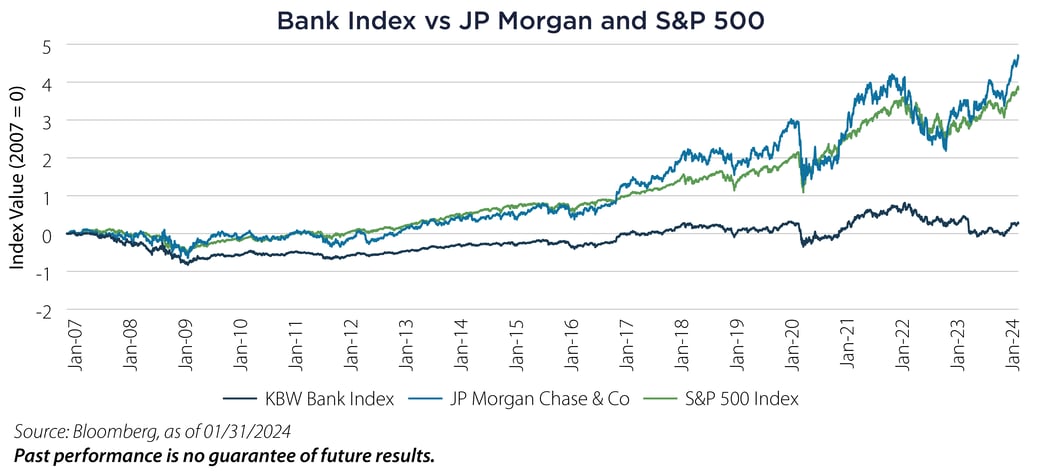

• The cumulative performance chart highlighted below reveals almost two decades of stagnant returns for the KBW Bank Index, contrasting with JP Morgan Chase's consistent outperformance linked to regulatory changes post-2008.

• The industry is undergoing a shift from rising interest rates to escalating credit losses, emphasizing the need for investor awareness.

We recently highlighted that despite the market showing positive signs following the March 2023 banking crisis, numerous issues persisted without resolution. With the recent downturn experienced by New York Community Bancorp, and without getting into any of those specific details, we aim to provide readers with a more comprehensive perspective on the overall system.

The chart above illustrates the cumulative performance of the KBW Bank Index compared to JP Morgan Chase and the S&P 500 Index since 2007. We are approaching nearly two decades of stagnant stock performance from the KBW Bank Index, while JP Morgan Chase has outperformed the S&P 500 Index. This discrepancy can be attributed to the regulatory changes following the Great Financial Crisis in 2008, which led to banks being regulated akin to utility companies. However, unlike utility companies with monopoly powers, banks operate in a commoditized business environment. In such a system, the rewards predominantly favor the scale provider, exemplified in this scenario by JP Morgan Chase. Smaller banks face difficulties in competing as they struggle to offer substantial differentiation from their competitors.

This characterizes the current operational landscape, marking the preliminary evaluation before examining critical elements like bank balance sheets, credit losses, interest rates, deposit flight and exposure to commercial real estate. The shift from a period of rising interest rates to one of mounting credit losses is in progress. Consider the insufficient preparation of these banks in mitigating interest rate risks. Can they adeptly navigate and handle the challenges presented by credit losses?

The industry confronts a persistent headwind that demands investor awareness before making any investment decisions. While opportunities for tactical trades may arise, as observed in the recent fourth quarter, accurate timing could be a challenge.

Important Disclosures & Definitions

KBW Bank Index: designed to track the performance of the leading banks and thrifts that are publicly-traded in the US. The Index includes 24 banking stocks representing the large US national money centers, regional banks and thrift institutions.

S&P 500 Index: widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

One may not invest directly in an index.

AAI000625 02/13/2025