We have to hand it to fund sponsors and their innovative efforts to satisfy the retail market demand for private markets access. With Sisyphean persistence1, fund sponsors have launched numerous vehicles over the past decade or so to access the trillions in retail investment assets and democratize access to private markets such as private equity, private real estate, private credit and private infrastructure.

These efforts have included business development companies, or BDCs (both traded and non-traded), non-traded Real Estate Investment Trusts (REITs), interval funds, tender offer funds, Special Purpose Acquisition Companies (SPACs), as well as blockchain-enabled tokenized share classes of existing private funds.

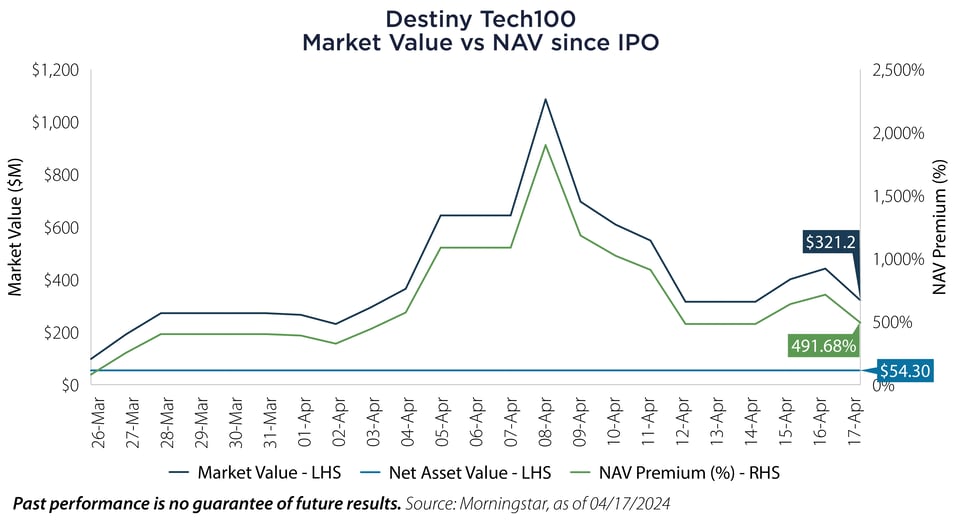

Most recently, the Destiny Tech100 Fund (DXYZ), a closed-end fund of private tech companies, began trading on the NYSE on March 26, 2024. DXYZ’s holdings include SpaceX, OpenAI, Stripe and Instacart, as well as a number of other private venture backed-companies. As illustrated nearby, investors clamored for access, bidding valuations to an astounding 1,900% NAV premium on April 8 before settling to a 492% premium as of this writing on April 17.

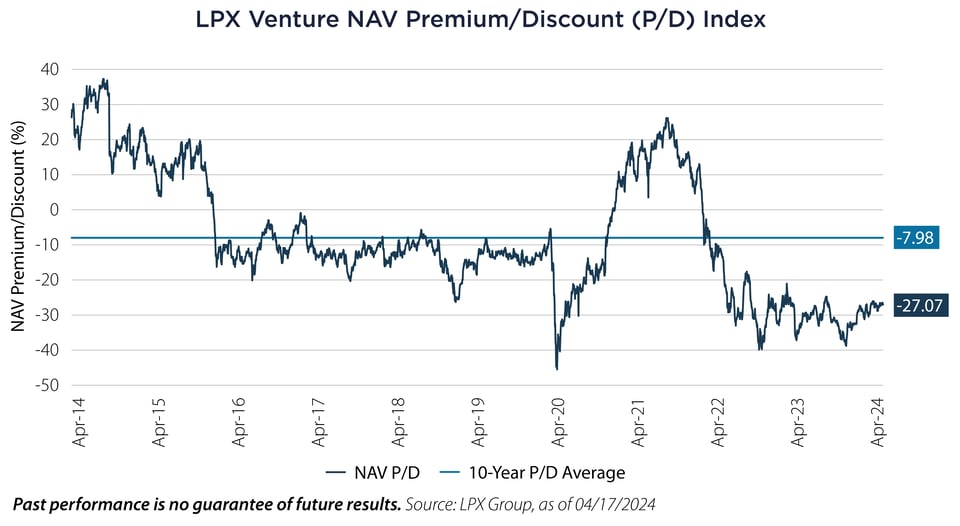

Similar closed-end fund vehicles, called Private Equity Investment Trusts, have been available in the UK and Europe for several decades. Currently, there are 40 listed private equity funds on the London Stock Exchange which collectively manage $50 billion in assets.2 As is common for closed-end vehicles, the market value of the funds can trade above or below NAV over time, as illustrated nearby. Notably, similar closed-end funds holding private venture-backed technology companies are currently trading at a -27% discount and an -8% average discount over the past decade, a stark contrast from the 492% premium noted earlier.

We remind investors that illiquidity, lack of transparency and limited access to private equity are generally thought of as “features” and not “bugs” for this asset class. The dispersion of returns between top- and bottom-quartile manager performance can be significant, so manager selection is paramount. Information asymmetry (i.e. becoming a private company with de minimis reporting requirements), the flexibility and patience to hold an investment through volatile periods, the ability to avoid forced selling and drawdowns and the capacity for highly focused allocations to the most promising opportunities, are hallmarks of this investment approach.

Investors seeking more liquidity through listed vehicles will typically encounter much higher volatility and potentially more significant drawdowns – which could be detrimental to achieving longer-term investment goals and favorable investment outcomes. The structure of some of these vehicles can limit manager investment discretion, which may also contribute to lower performance.

We believe that private markets can provide attractive risk-adjusted returns and improve outcomes for investors and fund sponsors who, like Sisyphus, will likely continue their quest to provide private markets access to the retail market via strategies and investment vehicles. Although different vehicles and strategies can provide unique advantages vs. traditional illiquid private investing, there are often significant investor trade-offs. Early results indicate this most recent approach may create more challenges than benefits.

Important Disclosures & Definitions

1 Sisyphus, a character in Greek mythology who symbolizes the power of perseverance. He was condemned by the gods to repeat the task of pushing a boulder up a mountain, only to see it roll down again, to repeat for eternity.

2 Source: City Wire, as of 02/22/2024

Discount/Premium to Net Asset Value (NAV): the difference between the market price and the NAV of a closed-end fund, expressed in percentage terms.

LPX Venture NAV Premium/Discount Index: aims to reflect the average pricing level of Listed Private Equity companies which pursue venture capital investing. The LPX Venture NAV P/D Index is diversified across private equity investment styles, financing styles and vintages. One may not invest directly in an index.

AAI000681 04/23/2025