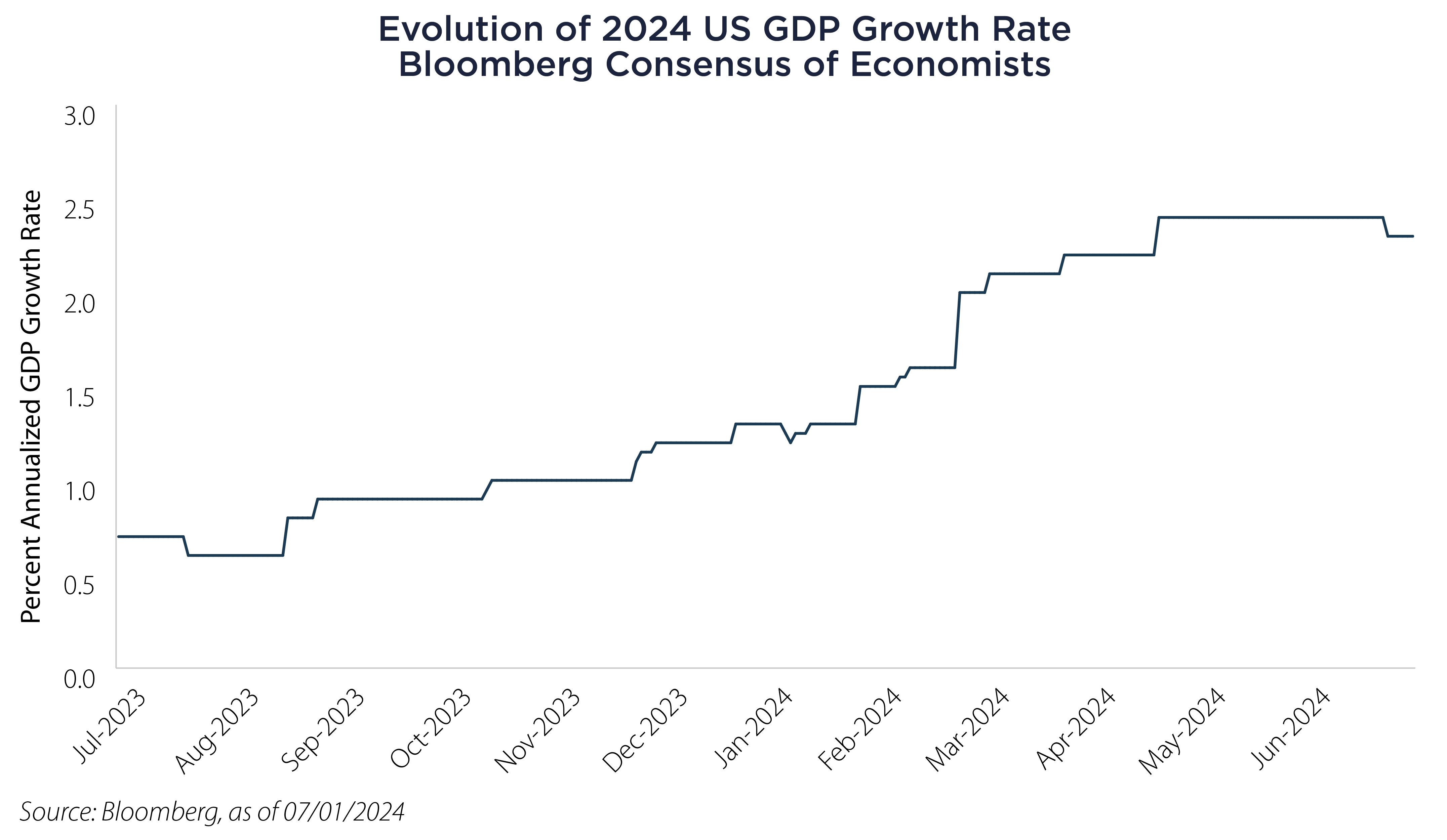

In October 2023, the Bloomberg consensus of economists expected less than 1% real growth for 2024. At the time, we made the case that the US still had above-potential growth in the pipeline. Global inventory relative to new order demand, a still hot labor market, the wealth effect and US fiscal policy were all catalysts working into our view. As shown in the chart below, this has now become consensus.

Change of Tune

We no longer see the same significant upside risk to US economic growth in the short term. Instead, we have a more balanced view of risks and are increasingly focused on the normalization of the labor market, cooling wage growth and other signs of slowing inflation and economic growth. It’s all starting to happen a bit faster now, and the key point is that the Federal Reserve (Fed) and its officials may still be leaning hawkish. Will they be behind the curve … again?

Here are the data the Federal Reserve points to when they consider how to adjust their policy:

- The level of job openings has dropped below its pre-pandemic trend line, and the level of job openings less workers seeking employment has fallen to its pre-pandemic level.

- The US unemployment rate is at 4%, up from 3.4% and already at the 2024 year-end median projection from the Federal Reserve’s June Summary of Economic Projections (SEP).

- The Core Personal Consumption Expenditures Price Index (PCE) is at 2.6%, down from 5.5% 20 months ago and already two tenths below the 2024 year-end median projection from the Federal Reserve’s June SEP.

The following is an excerpt from Chair Powell’s June 12th Federal Reserve meeting press conference:

“We’ve stated that we do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward two percent. So far this year, the data have not given us that greater confidence. The most recent inflation readings have been more favorable than earlier in the year, however, and there has been modest further progress toward our inflation objective. We will need to see more good data to bolster our confidence that inflation is moving sustainably toward two percent.” – Fed Chair Jerome Powell, June 12, 2024

It appears the data from the second quarter and the Fed’s rhetoric are not in sync. If the data continues to come in soft, we expect the Fed’s words and actions to adjust.

Low Margin for Error

The market has seemingly priced in the coveted “soft landing”, with investment grade credit spreads just off 2021 tights and major equity indices unevenly chasing all-time highs at above average valuations. The risk with this consensus positioning now is its dependency on the Federal Reserve to deliver the right amount of rate cuts at roughly the right time to lower the real rate of interest and its associated economic burden on business and investment. Reducing restrictive policy too little or too late risks sapping business confidence and opening a window of economic vulnerability.

To make matters more complex, it may be that window is already beginning to open. Here are some data we watch closely to detect potential inflection points in the growth cycle:

- Building permits have just hit a post-pandemic low, falling -28% from their December 2021 high and slipping -11% over the last three months.

- Housing starts have hit a post-pandemic low, falling -30% from their April 2022 high and slipping -17% over the last three months.

- Retail sales are sputtering, averaging only 0.06% month-over-month on a 6-month moving average basis for the last three months sequentially.

- For the first time since January 2023, the ISM Manufacturing Purchasing Manager’s Index (PMI) fell for three months sequentially while below 50.

Some of these data tend to be volatile and have produced noisier signals in the post-pandemic period, so we try to take each series with a grain of salt. What we look for is the buildup of these signals confirming strength or weakness in different segments such as housing, the consumer and manufacturing. Importantly, another risk is that the economy’s biggest tailwind of fiscal policy may also shift from overdrive to more neutral depending on the results of the coming election cycle.

We’re keeping a close eye on the data as we believe the time may be coming for the Federal Reserve to act. With falling inflation, the Fed risks running increasingly restrictive real rates on an economy beginning to show signs of weakness in a time of political and fiscal policy uncertainty. For more on the real-time economic pulse and how we’re adjusting our portfolio allocations, feel free to reach out to the SS&C ALPS Advisors Multi-Asset Research Team.

Important Disclosures & Definitions

Investment Grade: a rating that signifies that a municipal or corporate bond presents a relatively low risk of default. To be considered an investment grade issue, the company must be rated at 'BBB' or higher by Standard and Poor's or Moody's. Anything below this 'BBB' rating is considered non-investment grade.

ISM Manufacturing PMI: measures the change in production levels across the US Economy from month to month.

Personal Consumption Expenditures Price Index (PCE): a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The PCE is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

One may not invest directly in an index.

AAI000720 07/09/2025