With Major League Baseball Spring Training in full swing and Opening Day only a few weeks away, baseball analogy season is also here. In this light, the flurry of contextual changes we are witnessing in markets cause us to think that now’s a time to take a less aggressive stance, choke up on the bat, take a pitch and wait for something to swing at.

As we look at the investment market action over the first two months of 2025 our heat map of contextual changes is flashing as red as it has since 2020. This perspective doesn’t prescribe fear or panic – but it does suggest that getting to neutral shelter is a wise move as the forces that set a new, stable context battle for supremacy.

As a sample of changes that are mixing up the contextual direction of markets, let’s look at three dynamics that may merit very different positioning compared to what has worked over the last two years.

First, China is emerging from its slumber among emerging markets. Year-to-date, large cap China equities (represented by the FTSE China 50 Index) have outperformed the Emerging Markets ex China (represented by the MSCI Emerging Markets ex China Index) by over 20%. This is a developing trend that began with a shock last September, when China signaled a fresh commitment fighting deflation. Many individuals and institutions had given up on China, but the evidence refects that capital is flowing back. Second, Owner’s Equivalent Rent (OER), the largest portion of the core Consumer Price Index (CPI) calculation is set to increase, making lower inflation a meaningful challenge in 2025. Driving this is a combination of steep declines in multifamily housing starts, extraordinarily low vacancy rates, strong household formation and unaffordability of single family homes.

Second, Owner’s Equivalent Rent (OER), the largest portion of the core Consumer Price Index (CPI) calculation is set to increase, making lower inflation a meaningful challenge in 2025. Driving this is a combination of steep declines in multifamily housing starts, extraordinarily low vacancy rates, strong household formation and unaffordability of single family homes.

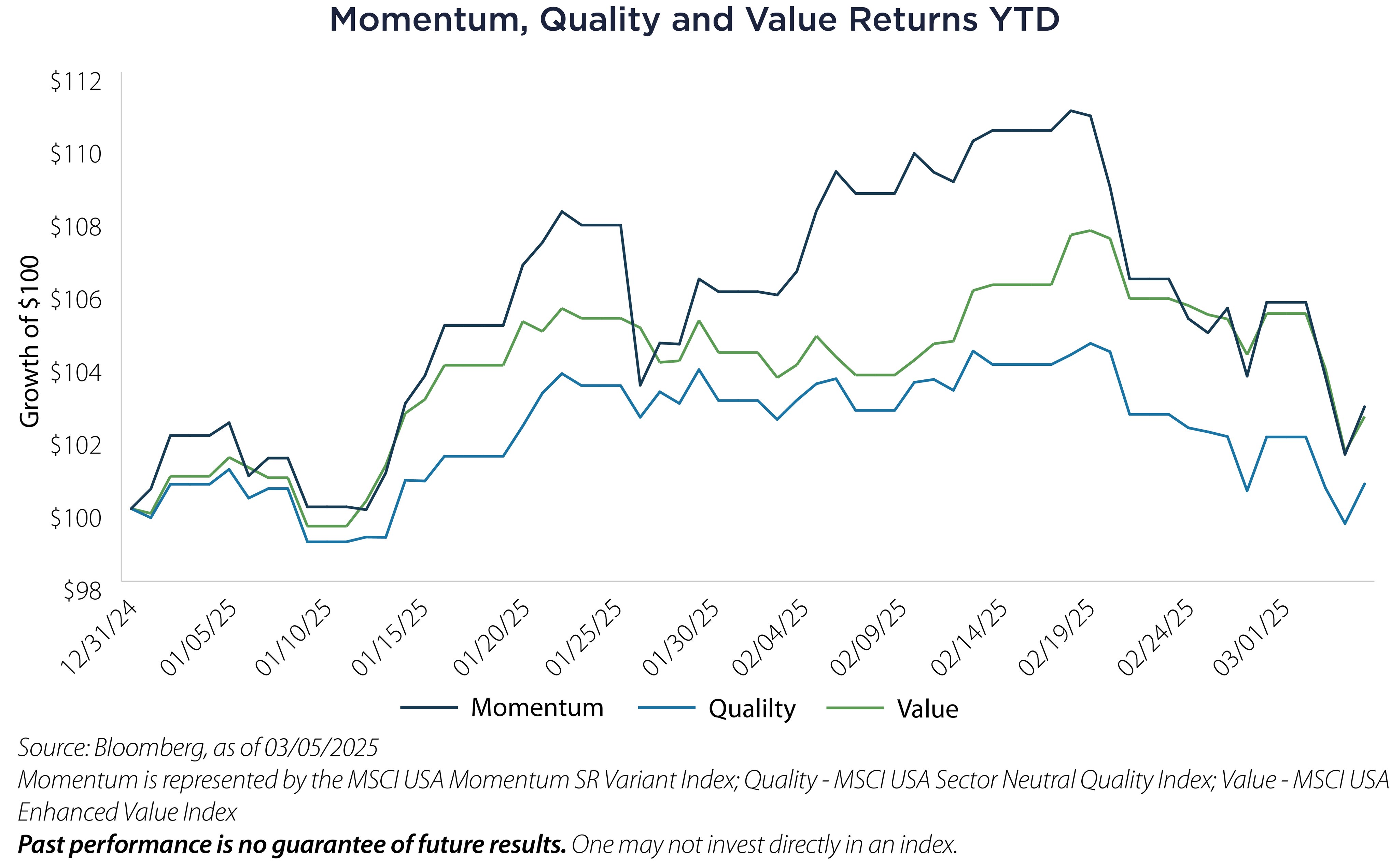

Third, Momentum factor dominance may be peaking relative to Quality and Value factors. As we highlighted recently, in prior years such as 2024, when Momentum dominates, approximately 70% of the time Momentum underperforms the broader market.

Third, Momentum factor dominance may be peaking relative to Quality and Value factors. As we highlighted recently, in prior years such as 2024, when Momentum dominates, approximately 70% of the time Momentum underperforms the broader market.

The potential combined-impact of new capital flowing to Chinese Equities, persistent and perhaps accelerating inflation pressure in the United States and a behavioral wave that causes investors to rethink their commitment to narrow themes in a momentum driven market is worth taking to heart.

And just like a batter that’s facing a pitcher with nasty stuff, sometimes its best to just take a pitch…or two.

Important Disclosures & Definitions

Consumer Price Index (CPI): a measure of the average change over time in the prices paid by urban consumers for a representative basket of consumer goods and services.

FTSE China 50 Index: a real-time tradable index comprising 50 of the largest and most liquid Chinese stocks (H Shares, Red Chips and P Chips) listed and trading on the Stock Exchange of Hong Kong (SEHK).

MSCI Emerging Markets ex China Index: captures large and mid-cap representation across 23 of the 24 Emerging Markets (EM) countries excluding China. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

MSCI USA Enhanced Value Index: captures large and mid-cap representation across the US equity markets exhibiting overall value style characteristics.

MSCI USA Momentum SR Variant Index: aims to reflect the performance of the MSCI USA Momentum Index, wherein all changes driven by the index rebalances of the MSCI USA Momentum Index are distributed over three days leading into the rebalancing effective date.

MSCI USA Sector Neutral Quality Index: captures large and mid-cap representation across the US equity markets. The index aims to capture the performance of securities that exhibit stronger quality characteristics relative to their peers within the same GICS sector by identifying stocks with high quality scores based on three main fundamental variables: high Return-on-Equity (ROE), low leverage and low earnings variability.

Owner's Equivalent Rent (OER): amount of rent that would have to be paid in order to substitute a currently owned house as a rental property. Surveyed data.

One may not invest directly in an index.

AAI000898 03/11/2026