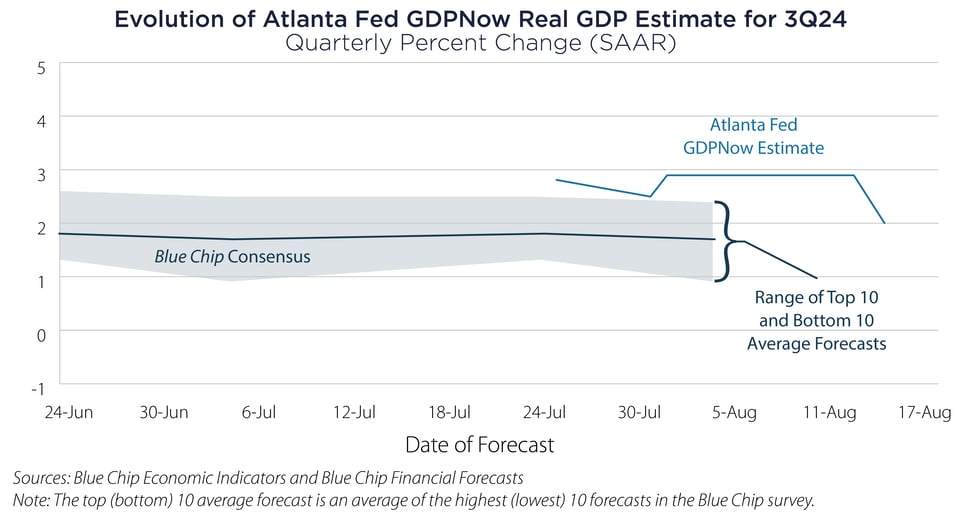

This week we wanted to dive into our US equity market playbook in the face of slowing GDP growth and increased volatility. One measure that we like to track to inform our macro-economic contextual view is the Atlanta Fed’s GDPNow forecasting model. This is not an official forecast of the Atlanta Fed, but rather a tool that helps inform the running estimate of US GDP based on available economic data for the current quarter. This, in turn, becomes an insightful measure of the current environment compared to consensus expectations.

The most recent estimate from the model dropped from 2.9% on August 8th to 2.0% on August 16th. The primary drivers of the decline are softening housing starts and continued weakness in industrial production. These datapoints corroborate our own research that sees increasing company-level anecdotal evidence of slowing orders and revenue.

This softening also makes sense as the equity market struggles through new volatility-driven fears of a hard-landing or recession. The consensus economic view is that the US can still avoid recession, but the data are starting to push a new, more concerning, narrative. Slower growth and emergent volatility should not be ignored. Now is a good time to dust off the slow-growth playbook.

The key conclusion, for us, is that emphasizing incremental investment in areas like Consumer Staples and Health Care may help cushion any drawdown related to declining expectations of growth and profits. Both sectors are classically defensive, but we also see evidence of thematic growth that should stand out on a cyclical basis as both discretionary consumer spending and industrial investment possibly slow into 2025.

Innovation among medical device companies, pharmaceutical companies and a return to secular revenue growth for health insurance and care providers are all themes we believe may provide safe havens in a potential macro-driven storm.

Sectors that look less attractive in this playbook are Technology and Industrials. Although there are always winners at the stock-level in each sector, we see few immediate opportunities to add capital in these two sectors driven by concern for moderating enterprise-level investment and less fiscal stimulus.

Although the tremors we’re seeing in the market may best be met with a change in exposure, we are always fans of staying fully invested in your individual equity allocation. Even if growth slows more than expected, the market will find its footing and may discount the eventual improvement sooner than most people expect. It’s almost impossible to get the top and bottom of a cycle right. So, stay fully invested, and think about risk-management on the margin with Health Care and Consumer Staples exposure.

Important Disclosures & Definitions

AAI000744 08/27/2025