• The Healthcare sector has underperformed the broader market significantly over the past several months.

• While the sector faces several near-term headwinds, it remains a relatively high-quality segment with long-term demographic advantages.

Earlier this week we held our year-end SS&C ALPS Advisors Investment Committee meeting, and one of the things that got our attention is areas of the market that have underperformed. One of the notable sectors that underperformed significantly in the second half is large-cap healthcare.

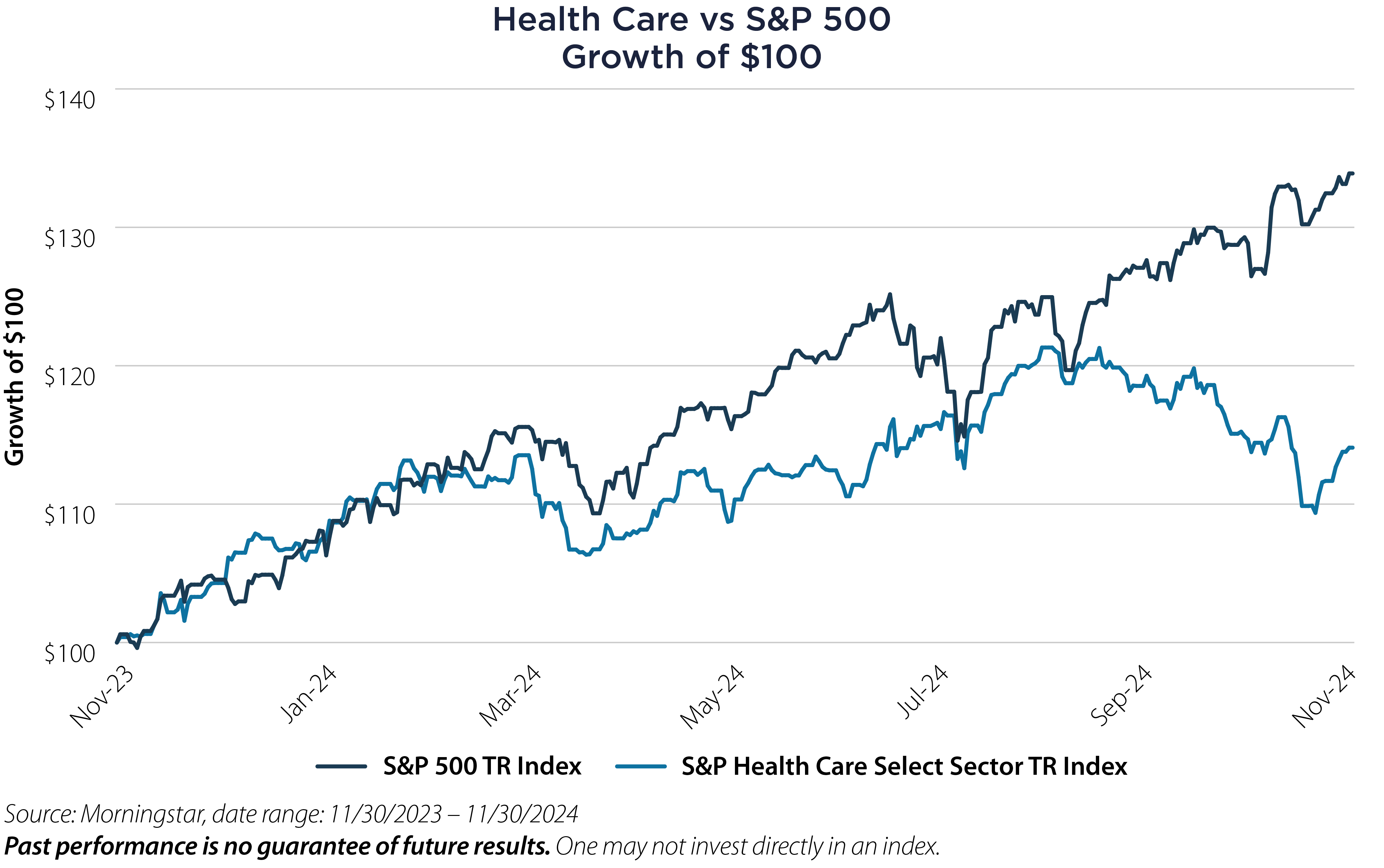

The chart nearby illustrates the performance of the S&P Health Care Select Sector TR Index vs. the S&P 500 TR Index over the trailing 12 months.

There are several headwinds that have been highlighted over the past few months, most importantly the view that the incoming Trump administration could pose risks in terms of increased regulation and scrutiny, primarily for pharmaceutical firms. Additionally, reduced demand for COVID-19 related services such as testing, vaccines and other treatments have weighed on sentiment.

On the other hand, the sector exhibits relatively high-quality characteristics, which we view positively. The median Return on Invested Capital (ROIC) for healthcare stocks over $15 billion market cap is roughly 200 basis points higher than the median S&P company.1 In addition, the demographic trends of an aging population are firmly in place in the US, which should drive continued demand for healthcare products and services.

While none of us know the future, we believe it is prudent to keep a close eye on this sector in 2025. The recent relative weakness may provide an attractive opportunity.

Important Disclosures & Definitions

1 UBS Global Research, 12/05/2024

Basis Point (bps): a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument.

Return on Invested Capital (ROIC): a calculation used to assess efficiency in allocating capital to profitable investments.

S&P 500 Index: widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

S&P Health Care Select Sector Index: a sub-index of the S&P 500 Index. All components of the S&P 500 are assigned to one of the eleven Select Sector Indices, which seek to track major economic segments and are highly liquid benchmarks. Stock classifications are based on the Global Industry Classification Standard (GICS). Capping is applied to ensure diversification among companies within each index.

One may not invest directly in an index.

AAI000849 12/10/2025